Form 1095-A - Fill, Sign Online, Download & Print - No Signup

CAUTION: NOT FOR FILING

Form 1095-A is provided here for informational purposes only.

Health Insurance Marketplaces use Form 1095-A to report information on enrollments in a

qualified health plan in the individual market through the Marketplace. As the form is to be

completed by the Marketplaces, individuals cannot complete and use Form 1095-A

available on

IRS.gov

. Individuals receiving a completed Form 1095-A from the Health

Insurance Marketplace will use the information received on the form and the guidance in the

instructions to assist them in filing an accurate tax return.

Form

1095-A

Department of the Treasury

Internal Revenue Service

Health Insurance Marketplace Statement

Do not attach to your tax return. Keep for your records.

Go to

www.irs.gov/Form1095A

for instructions and the latest information.

VOID

CORRECTED

OMB No. 1545-2232

20

24

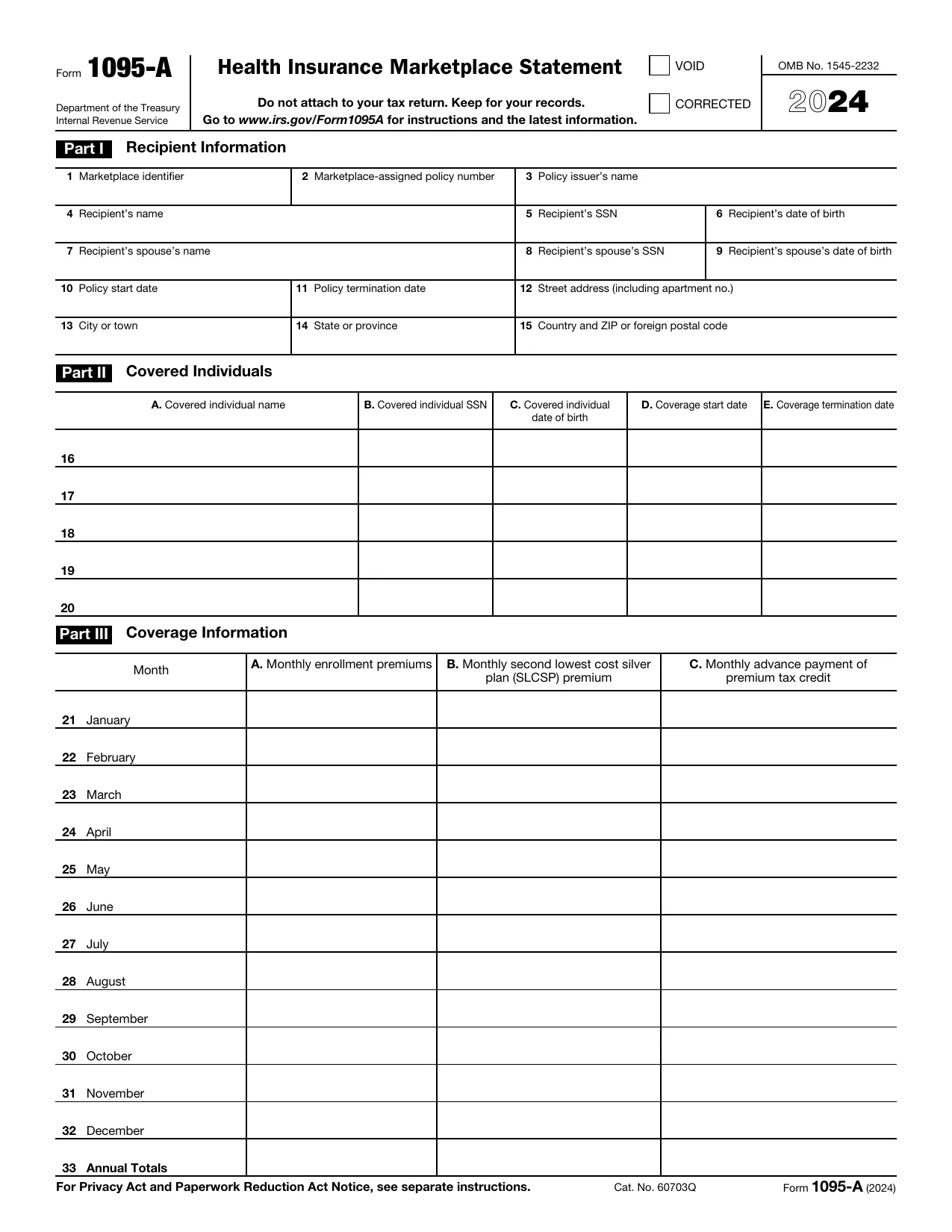

Part I

Recipient Information

1

Marketplace identifier

2

Marketplace-assigned policy number

3

Policy issuer’s name

4

Recipient’s name

5

Recipient’s SSN

6

Recipient’s date of birth

7

Recipient’s spouse’s name

8

Recipient’s spouse’s SSN

9

Recipient’s spouse’s date of birth

10

Policy start date

11

Policy termination date

12

Street address (including apartment no.)

13

City or town

14

State or province

15

Country and ZIP or foreign postal code

Part II

Covered Individuals

A.

Covered individual name

B.

Covered individual SSN

C.

Covered individual

date of birth

D.

Coverage start date

E.

Coverage termination date

16

17

18

19

20

Part III

Coverage Information

Month

A.

Monthly enrollment premiums

B.

Monthly second lowest cost silver

plan (SLCSP) premium

C.

Monthly advance payment of

premium tax credit

21

January

22

February

23

March

24

April

25

May

26

June

27

July

28

August

29

September

30

October

31

November

32

December

33

Annual Totals

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 60703Q

Form

1095-A

(2024)

Form 1095-A (2024)

Page

2

Instructions for Recipient

You received this Form 1095-A because you or a family member

enrolled in health insurance coverage through the Health Insurance

Marketplace. This Form 1095-A provides information you need to

complete Form 8962, Premium Tax Credit (PTC).

You must complete

Form 8962 and file it with your tax return (Form 1040, Form

1040-SR, or Form 1040-NR) if any amount other than zero is shown

in Part III, column C, of this Form 1095-A (meaning that you

received premium assistance through advance payments of the

premium tax credit (also called advance credit payments)) or if you

want to take the premium tax credit.

The filing requirement applies

whether or not you’re otherwise required to file a tax return. If you are

filing Form 8962, you cannot file Form 1040-NR-EZ, Form

1040-SS, or Form 1040-PR. The Marketplace has also reported the

information on this form to the IRS. If you or your family members

enrolled at the Marketplace in more than one qualified health plan

policy, you will receive a Form 1095-A for each policy. Check the

information on this form carefully. If you think the information is

incorrect, or if you think you should not have received a Form 1095-A

because neither you nor anyone else in your family was enrolled in

Marketplace health insurance, please contact your Marketplace Call

Center. If you purchased insurance through the Federally-facilitated

Marketplace, you can find your Call Center information at

www.healthcare.gov/contact-us/

. If you purchased insurance through a

State-based Marketplace, you can find your Call Center information on

your State-based Marketplace website. You can find a list of State-

based Marketplace websites at

www.healthcare.gov/marketplace-in-

your-state/

. If you or your family members were enrolled in a

Marketplace catastrophic health plan or separate dental policy, you

aren’t entitled to take a premium tax credit for this coverage when you

file your return, even if you received a Form 1095-A for this coverage.

For additional information related to Form 1095-A, go to

www.irs.gov/

Affordable-Care-Act/Individuals-and-Families/Health-Insurance-

Marketplace-Statements

.

Additional information.

For additional information about the tax

provisions of the Affordable Care Act (ACA), including the premium tax

credit, see

www.irs.gov/Affordable-Care-Act/Individuals-and-Families

or

call the IRS Healthcare Hotline for ACA questions (800-919-0452).

VOID box.

If the “VOID” box is checked at the top of the form, you

previously received a Form 1095-A for the policy described in Part I.

That Form 1095-A was sent in error. You shouldn’t have received a

Form 1095-A for this policy. Don’t use the information on this or the

previously received Form 1095-A to figure your premium tax credit on

Form 8962.

CORRECTED box.

If the “CORRECTED” box is checked at the top of

the form, use the information on this Form 1095-A to figure the premium

tax credit and reconcile any advance credit payments on Form 8962.

Don’t use the information on the original Form 1095-A you received for

this policy.

Part I. Recipient Information, lines 1–15.

Part I reports information

about you, the insurance company that issued your policy, and the

Marketplace where you enrolled in the coverage.

Line 1.

This line identifies the state where you enrolled in coverage

through the Marketplace.

Line 2.

This line is the policy number assigned by the Marketplace to

identify the policy in which you enrolled. If you are completing Part IV of

Form 8962, enter this number on line 30, 31, 32, or 33, box a.

Line 3.

This is the name of the insurance company that issued your

policy.

Line 4.

You are the recipient because you are the person the

Marketplace identified at enrollment who is expected to file a tax return

and who, if qualified, would take the premium tax credit for the year of

coverage.

Line 5.

This is your social security number (SSN). For your protection,

this form may show only the last four digits. However, the Marketplace

has reported your complete SSN to the IRS.

Line 6.

A date of birth will be entered if there is no SSN on line 5.

Lines 7, 8, and 9.

Information about your spouse will be entered only if

advance credit payments were made for your coverage. The date of

birth will be entered on line 9 only if line 8 is blank.

Lines 10 and 11.

These are the starting and ending dates of the policy.

Lines 12 through 15.

Your address is entered on these lines.

Part II. Covered Individuals, lines 16–20.

Part II reports information

about each individual who is covered under your policy. This information

includes the name, SSN, date of birth, and the starting and ending dates

of coverage for each covered individual. For each line, a date of birth is

reported in column C only if an SSN isn’t entered in column B.

If advance credit payments are made, the only individuals listed on

Form 1095-A will be those whom you certified to the Marketplace would

be in your tax family for the year of coverage (yourself, spouse, and

dependents). If you certified to the Marketplace at enrollment that one or

more of the individuals who enrolled in the plan aren’t individuals who

would be in your tax family for the year of coverage, those individuals

won’t be listed on your Form 1095-A. For example, if you indicated to

the Marketplace at enrollment that an individual enrolling in the policy is

your adult child who will not be your dependent for the year of coverage,

that child will receive a separate Form 1095-A and won’t be listed in

Part II on your Form 1095-A.

If advance credit payments are made and you certify that one or more

enrolled individuals aren’t individuals who would be in your tax family for

the year of coverage, your Form 1095-A will include coverage

information in Part III that is applicable solely to the individuals listed on

your Form 1095-A, and separately issued Forms 1095-A will include

coverage information, including dollar amounts, applicable to those

individuals not in your tax family.

If advance credit payments weren’t made and you didn’t identify at

enrollment the individuals who would be in your tax family for the year of

coverage, Form 1095-A will list all enrolled individuals in Part II on your

Form 1095-A.

If there are more than five individuals covered by a policy, you will

receive one or more additional Forms 1095-A that continue Part II.

Part III. Coverage Information, lines 21–33.

Part III reports information

about your insurance coverage that you will need to complete Form

8962 to reconcile advance credit payments or to take the premium tax

credit when you file your return.

Column A.

This column is the monthly premiums for the plan in which

you or family members were enrolled, including premiums that you paid

and premiums that were paid through advance payments of the

premium tax credit. If you or a family member enrolled in a separate

dental plan with pediatric benefits, this column includes the portion of

the dental plan premiums for the pediatric benefits. If your plan covered

benefits that aren’t essential health benefits, such as adult dental or

vision benefits, the amount in this column will be reduced by the

premiums for the nonessential benefits. If the policy was terminated by

your insurance company due to nonpayment of premiums for 1 or more

months, then a -0- may appear in this column for these months

regardless of whether advance credit payments were made for these

months. See the instructions for Form 8962, Part II, on how to complete

Form 8962 if -0- is reported for 1 or more months.

Column B.

This column is the monthly premium for the second lowest

cost silver plan (SLCSP) that the Marketplace has determined applies to

members of your family enrolled in the coverage. The applicable SLCSP

premium is used to compute your monthly advance credit payments

and the premium tax credit you take on your return. See the instructions

for Form 8962, Part II, on how to use the information in this column or

how to complete Form 8962 if there is no information entered, the

information is incorrect, or the information is reported as -0-. If the

policy was terminated by your insurance company due to nonpayment

of premiums for 1 or more months, then a -0- may appear in this column

for the months, regardless of whether advance credit payments were

made for these months.

Column C.

This column is the monthly amount of advance credit

payments that were made to your insurance company on your behalf to

pay for all or part of the premiums for your coverage. If this is the only

column in Part III that is filled in with an amount other than zero for a

month, it means your policy was terminated by your insurance company

due to nonpayment of premiums, and you aren’t entitled to take the

premium tax credit for that month when you file your tax return. You

must still reconcile the entire advance payment that was paid on your

behalf for that month using Form 8962. No information will be entered in

this column if no advance credit payments were made.

Lines 21–33.

The Marketplace will report the amounts in columns A, B,

and C on lines 21–32 for each month and enter the totals on line 33. Use

this information to complete Form 8962, line 11 or lines 12–23.